What type of a credit profile is needed for a thriving business?

A thriving business needs to have a strong credit profile to ensure financial stability and growth. A credit profile is...

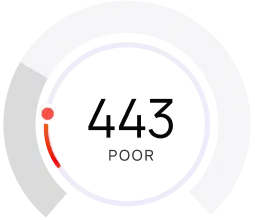

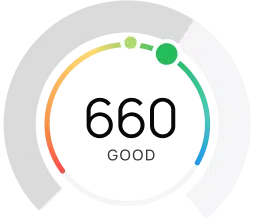

Always know your most up-to-date TransUnion credit score with daily refreshes.

Track your open accounts, debts, and other important factors that are impacting your credit score.

Get notified about changes to your credit file, so you can spot potential errors and protect your score.

Your credit score affects what card options you have, including the interest rate and credit limit you’re offered.

A good credit score can help you get your first home, dream home, or to refinance your current mortgage with the best rate available.

A higher credit score usually means a lower interest rate on auto loans, and smaller monthly payments.

We always treat your data as if it were our own

We protect your data with 256-bit encryption

We do not sell your personal info to third parties